child care tax credit portal

The White House released estimates in March that 390000 Connecticut families claimed a child and dependent care tax credit on their 2021 returns that was included as a relief measure in the American Rescue Plan. File a federal return to claim your child tax credit.

How Icici Bank Customer Can Download Form 16a Online Icici Bank Indirect Tax Banks Website

June 28 2021.

. For the 2021 tax year the CTC is worth. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Up to 3600 for each child age 0-5.

The advance child tax credit calculator will. Wednesday over 8000 applications had been filed. If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you.

Get your advance payments total and number of qualifying children in your online account. The Child Tax Credit provides money to support American families. Canceled checks or money orders.

You can use the IRS Child Tax Credit Update Portal to view your payment history and verify that a check has been mailed to you or that you have received direct deposits. Due to a change to the federal credit working families could get back up to 4000 in care expenses for one qualifying person and up to 8000 for two or more qualifying people. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. The United States federal child tax credit is a partially-refundable tax credit for parents with dependent children. To be a qualifying child for the 2021 tax year your dependent generally must.

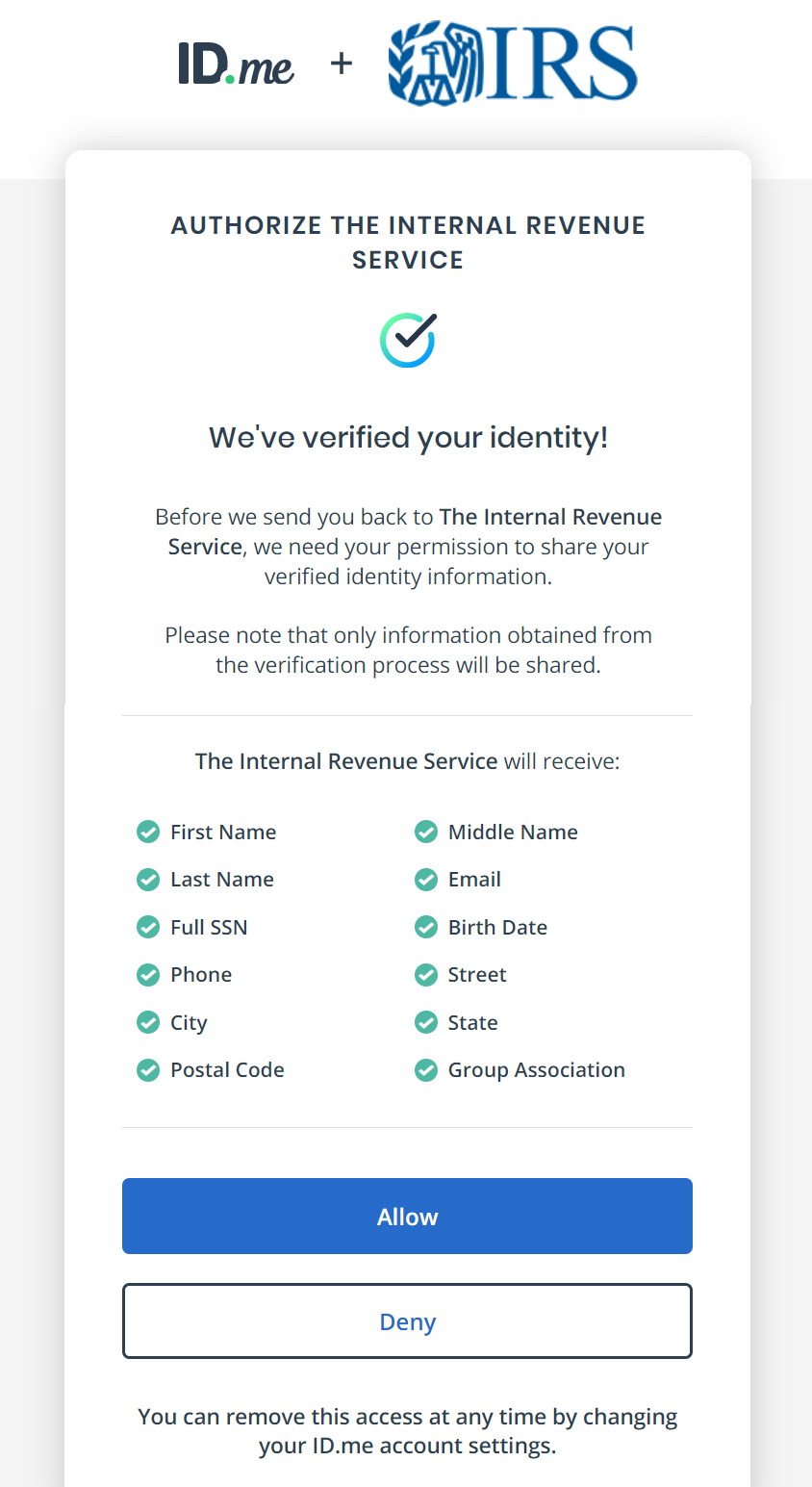

The Update Portal is available only on IRSgov. In 2021 almost every family will be eligible for an additional Child Tax Credit to help families recover from the pandemic and support our youngest Texans. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going to school. The Child Tax Credit CTC provides financial support to families to help raise their children. The federal Child and Dependent Care Credit helps families pay for child care for children under age 13 or for care of dependent adults.

Last year the tax credit was also fully refundable meaning that if the credit amount a taxpayer qualified for exceeded. Use this account to get your 30 hours free childcare or pay for your Tax-Free Childcare. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

Be your son daughter stepchild eligible foster child brother sister. In 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3600 per child under the age of 6 and 3000 per child. Specifically the Child Tax Credit was revised in the following ways for 2021.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax. Up to 3000 for each child age 6-17.

The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Cash receipts received at the time of payment that can be verified by the department. This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits.

For children under 6 the amount jumped to 3600. Even if you do not normally file tax returns you are still eligible to claim any Child Tax Credit benefits you are eligible for. Ad Discover trends and view interactive analysis of child care and early education in the US.

Get the up-to-date data and facts from USAFacts a nonpartisan source. Thanks to the American Rescue Plan signed by President Biden in March 2021 more families are eligible for the credit for the first time and. Enter your information on Schedule 8812 Form.

Be under age 18 at the end of the year. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18.

The credit amount was increased for 2021. For most families it will mean an extra 300 a month for each child under age six and 250 a month for those under age 17 including new babies. The state estimates as many as 350000 families will benefit and as of 5 pm.

What is the Child Tax Credit. 3600 per child under 6 years old. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single.

It provides 2000 in tax relief per qualifying child subject to an earned income threshold and phase-in. Getting the Child Tax Credit if you havent filed tax returns. The Department of Revenue Services to hold Live Virtual Event about the 2022 Child Tax Rebate on July 7 2022 Click here to learn more.

3000 per child 6-17 years old. Here is some important information to understand about this years Child Tax Credit. This secure password-protected tool is easily accessible using a smart phone or computer with internet.

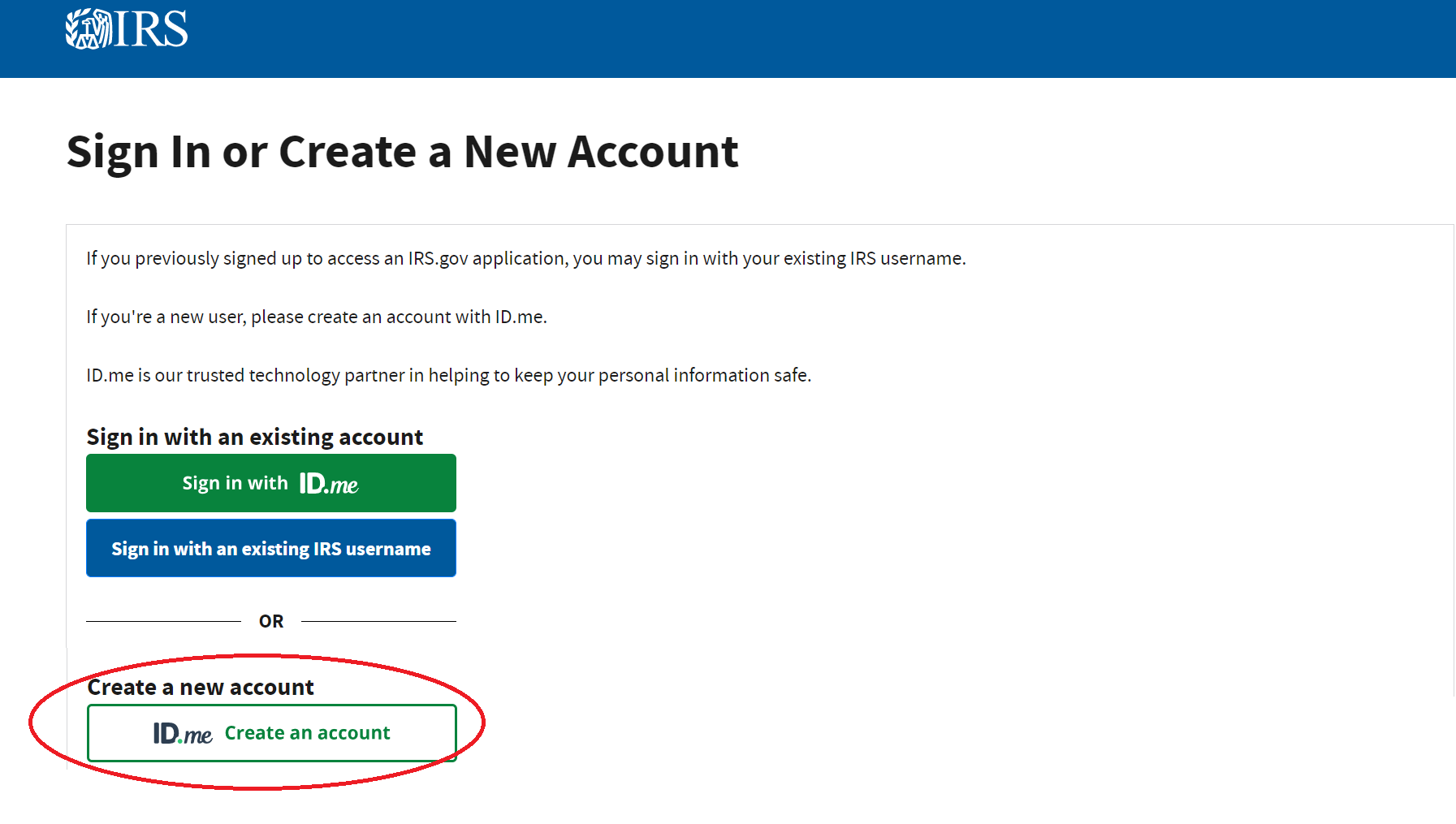

You will need the following information if you plan to claim the credit. Simple or complex always free. To apply applicants should visit portalctgovDRS and click the icon that says 2022 CT Child Tax Rebate The Department of Revenue Services is in the process of reaching out to more than 300000 households who may meet eligibility requirements through informational postcards that are being mailed this week.

To learn more about recordkeeping requirements see our Checklist for child and dependent care expenses. Additional information See Form IT-216 Claim for. The credit was made fully refundable.

The widget was created for low-income families those earning less than 12400 individually and 24800 for couples who arent required to file a. The letter that went out to qualifying families from the whitehouse earlier this year explains for 2021 most families with kids will get a tax relief payment of up to 3000 for each child between 6 and 17 years old and up to 3 600 for every child under 6 years old receiving the payment. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

To reconcile advance payments on your 2021 return. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Department of Revenue Services.

To keep getting your 30 hours free childcare or Tax-Free Childcare you must sign in every 3 months and. It also made the. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

If you did not file a tax return for 2019 or 2020 you likely did not. If you received direct deposits to your bank account. For 2022 that amount reverted to 2000 per child dependent 16 and younger.

The tool also allows families to unenroll from the advance payments if they dont want to receive them. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund. 2022 Child Tax Rebate.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Xne Financial Advising Tax Preparation By Xne Financial Advising Llc Via Slideshare Tax Preparation Financial Social Media

Budget Planner Budget Planner Budgeting Budget Saving

Childctc The Child Tax Credit The White House

Infographic On The Cost Benefits Of Outsourcing Bookkeeping Small Business Bookkeeping Bookkeeping Services Bookkeeping Business

Www Kidkare Com Login Guide For Kidkare Account Health Insurance Plans Private Health Insurance Accounting

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Pin By Rajesh Doye On Gst India Goods And Services Tax Goods And Services Education Goods And Service Tax

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Marissa Jacobs Do Noah Neighborhood Outreach Access To Health Family Medicine Healthcare Centers Health Education

Bsnl Erp Ess Portal Check Employees Salary Statement Eportal Erp Bsnl Co In Sap Netweaver Login Sap Netweaver Hrms Salary

Youth Soccer Academy Futsal Program Recreactional And Travel Programs Coral Springs Florida Soccer Academy Youth Soccer Coral Springs

Www Myfes Net Sgalyean Badcredit Needcredit Identitytheft Restoremycredit Increasemyscore Bestc Credit Repair Financial Education Credit Repair Business

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Maine Attracts College Grads With Student Loan Tax Credit Supporting Education Student Loans Community Development Family Finance