dependent care fsa limit 2022

If you would like to make. Dependent Care Assistance Plans Dependent Care FSA annual maximum unless married filing.

New Hsa Limits For 2022 And Determine If Fsa Or Hsa Is Right For You Alltrust Insurance

WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to.

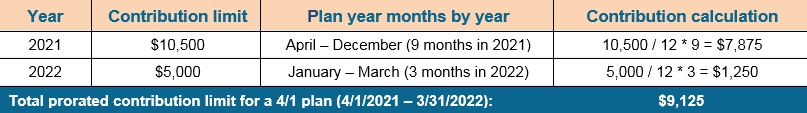

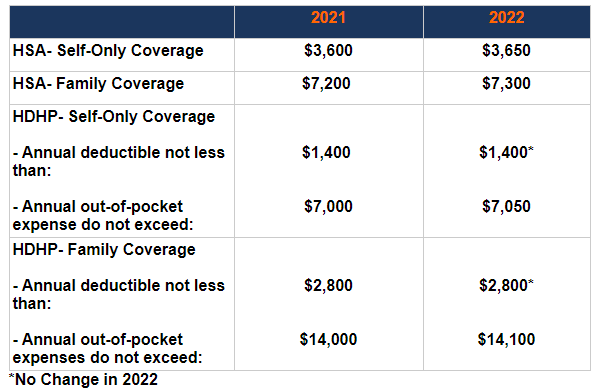

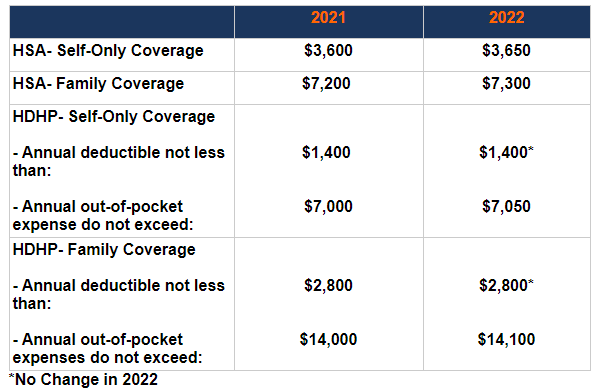

. Employees in 2022 can put up to 2850 into. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year. For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of the american rescue plan act of 2021 and that change has not been extended to 2022.

The IRS hasnt yet announced 2022 limits but your employer can tell you. This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the dependent care flexible spending account DCFSA. Ensure that the eligibility and benefits tests are also conducted.

For 2022 it remains 5000 a year for individuals or married couples filing. 125i IRS Revenue Procedure 2020-45. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute.

Employer adopts the carryover provision that provides the. The dependent care fsa dcfsa maximum annual contribution limit did not change for 2022. In addition the Dependent Care FSA DCFSA maximum annual contribution limit did not change and it remains at 5000 per household or 2500 if married filing separately.

3 rows 2022 Health FSA Contribution Cap Rises to 2850. Dependent Care Fsa Limit 2022 High Income. If you are divorced only the custodial parent may use a dependent-care FSA.

The employee incurs 2500 in dependent care expenses during the period from July 1 2022 to December 31 2022 and is reimbursed 2500 by the DC FSA. As a result the IRS has revised contribution limits for 2022. For the 2021 income year it is 2750 26 USC.

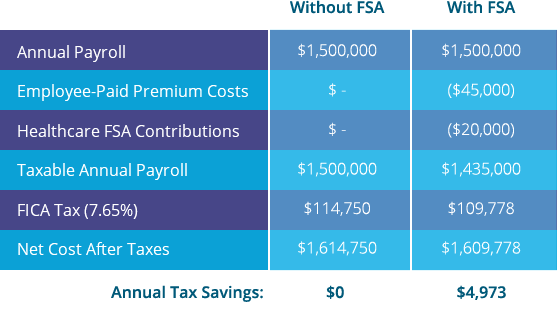

FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. If you have adopted a 570 rollover for the health care FSA in 2022 any amount that rolls over into the 2023 plan year does not affect the maximum limit that employees can contribute. What is the 2022 dependent care FSA limit.

The health FSA contribution limit is established annually and adjusted for inflation. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. 3 3 You can use a dependent care FSA to cover.

The IRS clarified that it wont tax dependent care flexible spending account funds for 2021 and 2022 that COVID-19 relief provisions allowed to be carried over from year to year or that are used. The health care standard or limited fsa rollover maximum limit will increase from 550 to 570 for plan years. The HCFSALEXHCFSA carryover limit is 20 percent of the.

This account is used to reimburse you for dependent care expenses such as child day care elder care etc. The employee receives a total. The 2022 dependent care FSA contribution limit returns to its previous limit of 5000 after an increase by the American Rescue Plan Act for 2021.

Unlike the health care FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by statute. Dependent Care Fsa Limit 2022 Income Limit. Health FSA Carryover Maximum.

The 2022 dependent care fsa contribution limit will remain at 5000 for single. The limit will return to 5000. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately.

Employee elects 5000 for the 2020 calendar plan year dependent care FSA but does not use any amount in the 2020 plan year. Transportation fringe benefits per month.

Fsa Carryover Everything You Need To Know About This Feature Bri Benefit Resource

Dependent Care Fsa Colorado Isd

Irs Releases Notice 2021 25 And Notice 2021 26 Oca

Your Dependent Care Fsa Babysitter Hiring Options Bri Benefit Resource

Flexible Spending Account Fsa Ameriflex

Fsa Eligibility Quick Facts Bba

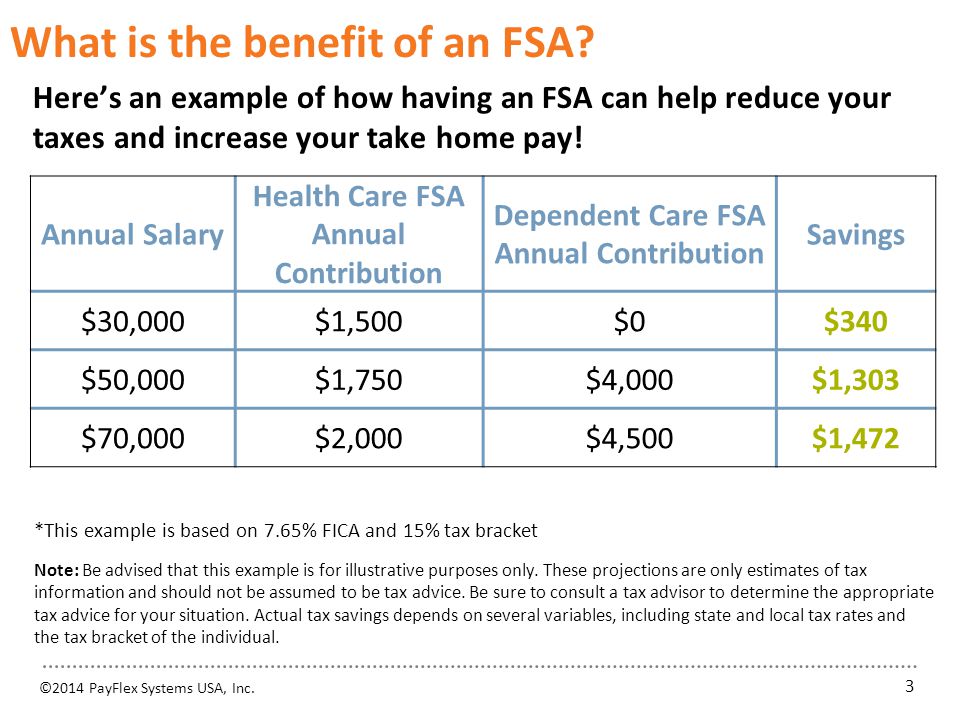

This Presentation Covers Ppt Download

Flexible Spending Arrangements Fsa And Dependent Care Assistance Program Dcap Washington State Health Care Authority

Summer Camp And Your Dependent Care Fsa Datapath Administrative Services